“This offer is available TODAY only; you’d better hurry while it lasts!”

“Normally I would charge much higher than this, but for you only, I’m making you a special offer that you can’t refuse.”

“You would be stupid to turn down such a good deal.”

Do these slogans sound familiar to you? If so, then you might have been the victim of high-pressure marketing tactics.

In my post about expected value, I talked about how it’s important to have strong emotions for those goals which are important to you; getting emotional about them imprints them on your brain, and drives you toward achieving your goals. When you direct your emotions under your own control, they can help serve you very effectively.

On the other hand, our emotions are also susceptible to influence by others. We are influenced all the time by the events that happen around us, by our family, our friends, and by our work. We can also be influenced by salespersons and brokers. These people are often quite skilled in developing trust and confidence in the people they deal with, and they use several skills to achieve this, such as manipulating your sense of fear & greed, establishing a position of authority, and using eye contact and touch to further manipulate your behavior.

The usual suspects:

- Car salesmen

- Real estate agents

- Mortgage brokers

- Timeshare brokers

- Financial planners

As usual, the wise approach is to look at the fundamentals, so keep the following things in mind when dealing with these people:

- What kind of reaction are they trying to elicit in me?

- What kind of benefit will they receive?

- Are their interests aligned with my own?

Remember to take your time and look at the fundamentals before committing to any big decisions. If the deal really is that great, then why would the salesperson have to try so hard to sell it? In the end, examine the fundamentals, look at the numbers, and, just like with women in the bedroom, make sure the salesperson understands that no means no.

Even when it’s April Fool’s Day, remember the above guidelines, and don’t be afraid to say no if it doesn’t feel right.

Originally published on April 1, 2010.

Yes, I am all too familiar with this scheming tactic. I do have to admit though, these schemers are good at what they do, I nearly got fooled a couple of times and almost gave in, but my rationality quickly kicked in, and thank god on time because once you’re hooked, you’re (pardon my French) *fudged*.

@Anne

Remember a certain time in Phuket…

I love it! I have grown to really watch out for this type of advertising. And how true is this in Internet Marketing? “Act NOW or you will never see this web page again!” or I am only going to “allow” the first 10 people into this course.

Ha! Yeah, I was just about to point out how many “bloggers” should be added to the list with their “Buy this e-book now! It’s only available once a year during this 48 hour period and you get 100 pages full of white space and blank pages for only for $147. I looooooove this product (Yes, I’m an affiliate and get 50% in affiliate commission, but I’m not doing this for the money even though I make most of my blogging income hyping other people’s ebooks) so buy it now; so I can eat tonight. Tell X I sent you and you also get a $1297 value mp3 file where my amazing cat interviews me about my remarkable awesomeness.”

LOL, I know about those ones too. “Buy these products for $97!”. If I come across something worth selling, I don’t mind promoting it, but I’m not so sure about some of those ebooks with their grossly exaggerated values…

Lovin’ this post 🙂

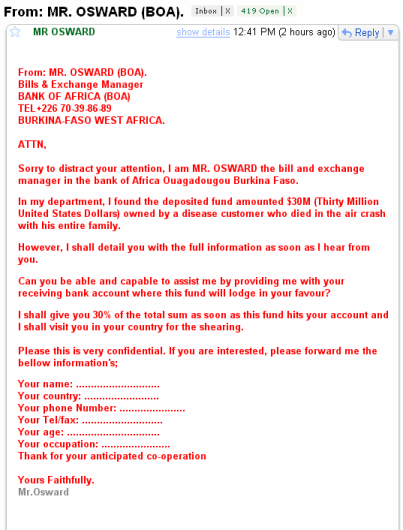

I swear I got the exact letter you published on this post (the one about using my bank account)….hokey!

Anything that says, “today only”, I pretty much always immediately throw it in the trash. If I have to fork up money without thinking, that has scam written all over it.

Yep and if there are any legit “today only schemes”, they probably don’t rely on spam to get the word out…

Great advice. It’s a jungle out there. The usual suspects are still out there because there are still victims that fall for the schemes. Why do we still get Nigerian scam emails? If we all change our mindsets, perhaps one day the usual suspects will disappear. Unlikely as “there’s a sucker born every minute” still rings true.

If it costs then 5 dollars to send 10 million emails, then even getting one sucker out of 10 million will be worth it. I think we need some changes to the mail infrastructure, like a fee for sending or routing transactions. If it cost you a fraction of a penny to send an email it wouldn’t bother you that much, but it would cost the spammers hundreds of thousands of dollars to spam the way they do.

We just need something that is truly online and decentralized to play this role. It would be a total mess and would have too much overhead if we tried to implement this using CCs or something similar. I think we will get there eventually though.

Doesn’t even have to be money, could be an expensive calculation or some other element of work, too… but that would probably be harder to standardize and comes with its own issues.

Excellent post, and great advice!! If its a good deal it will still be available tomorrow and the day after. Never rush into buying something, it’s your own hard earned money that you are spending so take your time.

Yep agreed. This happened to me a couple years ago during the holiday season; a couple of cute girls tried to sell me some beauty products for my gf and were a bit pushy because it was the “last day of the sale”. I still didn’t buy and when I came back the next day the sale was still on. 😛

Ahh, the proverbial “exploding offer”. I just want to yell douchbag! when I run into this. I’m confronted with these ultimatums here and there and always walk. As long as people always first understand that these offers are always made from a position of weakness, they know immediately it’s a bad deal (or scam).

Yeah I have learned over time to look at it that way. Some of these salespeople are pretty good at what they do and can make it seem the other way around if you’re not wise to their tricks.

I can’t believe people actually fall for this advertising. I always ignore this crap. It’s almost always a phishing email or malware. Thanks for the heads up and for this good topic.

It’s probably 1 in 10,000 or something like that, but if they send out millions of emails that can still be lucrative for them :S

Hi Kevin, I liked your point, if it was so great, why are they selling so hard? But, these tactics work otherwise, they wouldn’t be so prevalent.

Yep, they can manage to hit just enough to make it worthwhile. I wonder if there is ever a legit offer that the seller needs to push hard?